Credit Card Debt as a silent financial killer

Technology spoils people’s whims. It tends to cater to every human’s caprices. It feeds on the people’s undying thirst for easy, instant, and convenient. More often than not, it also causes them a lot of trouble—financial trouble through credit card debt—that is.

Credit Card convenience vs. Credit Card debt

We often see people pull out “plastic” to pay for everything they need. Why not? When all it takes is a quick swipe of the card through a little electronic box and a signature then, everything’s okay. You go home happy, content, and almost worry-free. On the other hand, not every one of these people realize that the convenience of using credit cards can lead to a false feeling of financial security. And this realization will strike them as soon as the bills arrive.

In fact, studies show that credit card debt and personal bankruptcies have increases bank profits to the highest level in the last five years. It only shows that more and more credit card holders were unable to manage their finances that lead to credit card debt. If you are a cardholder and having some credit card debt troubles at this early stage, it’ now time to think over the possible outcomes of this minor glitch so that a more serious problem with credit card debt would cease to arise.

Credit card gives people the feeling of invincibility. And it also gives them tons of uncertainty about their financial management capability when they encounter problems with their credit card debt. Although it is true that that credit cards solve financial matters especially when it comes to safety and convenience, credit cards also creates hassle especially when the person using it doesn’t know what you he or she’s getting into.

Indeed, paying off credit card debt may take a long time especially if the person has high interest rates. But, it doesn’t mean that you can do nothing about efficient management of credit card debt. When you find yourself overwhelmed with credit card debt, don’t fall into a pit of depression. You can get through it with discipline and a change in spending patterns. Start eliminating problems with credit card debt by getting tips and techniques on how to pay off your balances easier, how to consolidate of frequently encountered problems, look for free debt consultation agencies that can help you, and try—inch by inch—to rediscover ways on how you can regain your financial freedom by reducing you credit card debt.

The power to eliminate credit card debt

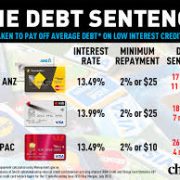

People who are having problems managing their credit card debt or those who are near in bankruptcy often don’t realize that the power to eliminate their credit card debt troubles totally is in their hands. Today, more and more Americans need credit card debt help badly. The main problem is that these families are having difficult times paying high interest for credit card debt. And instead of lifting the burden of credit card debt, more people are paying much in interest every month than that of the actual expenditure.

There are actually more lawful and moral ways to zero-out thousands of dollars in credit card debts. And if you only take the time to research and know your rights and how bankruptcy laws have changed, you will discover that there are valuable facts to eliminate credit card debt. Actually, the possibility of reducing or eliminating the high interest credit card debt is now more possible when a person takes action to get his or her finances back on track.

Apart from knowing your weapon in terminating credit card debt, it is very important that you develop a sense of control and perseverance first. Since credit card debt elimination process requires organization, clarity, and commitment to your own growth, it is a must that you are ready for the responsibility and to stand free and independent.

For those people who consider having a credit card indispensable but afraid of getting one because of the possibility of credit card debt nightmare, you must remember that credit card can be a powerful tool in managing your finances but there will always be glitches when not used properly. Of course, there are countless reasons why you should and shouldn’t get one depending on your needs. Whether you decide to get one or not, managing finances it still takes a sense of good budgeting, willingness to change spending habits, and the humility to avail low interest consolidation loans when you are already burdened by too much credit card debt.