A Quick Guide To Mortgage And Re Mortgage

Buying a dream home is one of the major milestones of any individual’s life. The price of real estate is increasing day by day. The designer and flashy homes, which appeal us the most, are beyond the financial capabilities of a lot of individuals. However, this fact should not deter us from fulfilling such a dream. With widely available low interest mortgages, now even a common man can own the residence of his choice.

Starting with the basics, mortgage is a type of loan that any individual can take, in order to buy a home or a property. The property being bought is used as collateral to the loan, this often means that if the repayments schedule of the mortgage is not complied with fully, the lender can take the possession of your property, and sell it to recover his amount.

Any mortgage deal whether it is the first one, or a remortgaging effort, requires a lot of hard work. The best advice given by any lender is cleverly disguised to suit his interest the most. So, the first thing that any borrower should do is to take a closer look at any lender’s advice and compare it with other offers floating in the market.

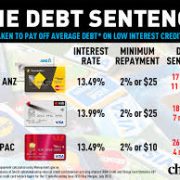

Choosing the mortgage that is right for you and getting the best deal, involves taking a lot of decisions. The two main things that require the greatest attention are the interest rates charged for the mortgage and the repayment method of the mortgage.

The rate of interest to be paid for mortgages are determined by the base rates prevailing in the loan market. A borrower should go for a low interest mortgage, since the lower the interest rate; the lower will be the monthly repayment. At any given point of time the borrower might get hundreds of offer for mortgage. Each lender has different conditions and charges. The borrower is advised not to succumb to any offer with cheap initial interest rates; instead he or she should look at all the features of mortgage before accepting any deal.

As for the repayment method the borrower has two options – a repayment mortgage or an interest only mortgage. In a repayment mortgage, the borrower has to pay off the amount in equally spaced instalments. The instalments gradually recover the principal amount coupled with the interest from the borrower. Thus, the mortgage is fully paid by the end of agreed term.

In an interest only mortgage only the interest is charged in the instalments. The principal amount is not included in the monthly repayments. The arrangement to repay the principal amount is made by other means, usually at the end of the mortgage term or as agreed between the two parties. The mortgage amount is guaranteed by some investment in shares, or stock. The borrower has to make sure that his investment grows, so as to pay the mortgage by the end of agreed term.

Most lenders will offer mortgage up to 95% of the property’s value under consideration, but the borrower might have to pay a higher lending charge if he borrows more than 75% of his property value. There are other costs also, which are essentially involved with a mortgage. The lender might ask you to deposit an amount up to 3-10% of the asking price of the property. Valuation fees, solicitor’s fees and higher lending charges also escalate the price of mortgage.

After deciding on a mortgage, the borrower has to apply formally to the lender. He should take care to fill in all the details carefully. If he feels confused at any stage he should take the help of a financial adviser, instead of making wrong assumptions. If everything goes smoothly the borrower will soon receive a mortgage offer.

Remortgaging means that we are taking a new mortgage to repay an existing one.

As time passes, the appreciation in property rates raises the home equity available at the disposal of the homeowner. Remortgaging utilises this increase in property valuation to get a better deal on debt, or some extra money. Remortgaging does not involve selling or changing homes, but the debt may be transferred from one lender to another.

There are instances, when we require funds for some new construction, such as an extra bathroom, new kitchen, additional bedroom etc. Many times we find that some of our existing borrowings, charge higher rates of interest than those charged by our mortgage lender. In such cases, we can use the additional home equity available with us to provide funds and ease the repayment burden by remortgaging.

Australia, in recent times has seen a sharp decline in mortgage rates. Therefore, more and more homeowners having existing mortgages are applying for a remortgage to take advantages of the lower rates. Remortgage has become an easy process due to the increasing use of information technology in the lending process. People can now apply online for a remortgage right from the comfort of their home or office. This has significantly reduced the time and effort for getting a property remortgaged.

Considering the reduced interest rates and easier repayment options, the homeowners often see remortgaging as good source for generating capital. Changing high interest debts into low interest remortgage with easy repayment terms is often, quite lucrative for the debtors. By changing their debt type they can significantly reduce the repayment burden.

There are many lenders in the Australian market, which provide competitive remortgage offers. Since, remortgages are used to move debts; it should be seriously considered that the cost of moving debts should not offset the savings in any such process.

The redemption fees, is the biggest cost to be incurred while taking a remortgage. A redemption fee is what a person has to pay when he ends an existing mortgage contract and applies for a remortgage. There are early redemption penalties, which escalate the overall costs of remortgage. These penalties are the largest when the debt is still new. Generally, remortgaging is not advised when such penalties are very high, but if you have a particularly good offer, which offsets the loss due to the early redemption penalty, you should consider it.

In addition to the redemption fee, there are many other costs involved with remortgaging. Some of which are discussed below:

- The new lender who will provide the debt will like to reassess the value of your property to make sure that it is not a risky deal for him. So, he might charge some valuation fees for this process.

- The entire remortgaging process has a legal angle attached to it. This might involve legal consultation fees. In addition to these, the lender might include the conveyance and other office charges.

The debtor should consider these fees while remortgaging. Options are available, where the lender might refund all or a part of the valuation, legal and office charges to the debtors, if the repayment schedule is exceptional. Be sure to ask your lender about such an option.

Remortgaging does provide funds with low interest and easy repayment options, but there are many drawbacks associated with it.

The debt repayment process again starts from the scratch. Short term savings might lead to a long term financial liability. The interests although relatively lower now must be paid over a longer period of time, and again the fact to be kept in mind is that any serious default in payments might lead to repossession.

DO YOU NEED A PROFESSIONAL MORTGAGE BROKER

TRUSTED PROPERTY MANAGEMENT COMPANY